Cost Of living Crisis

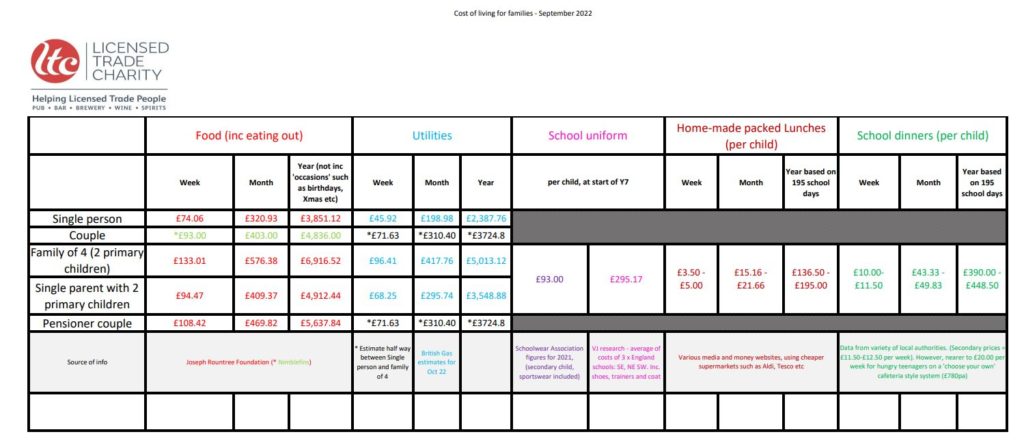

We all know the cost of living is rising and that many will find it difficult to afford their bills this year, especially during the winter months.

For licensed hospitality people (past and present) we’ve pulled together as many useful resources and links as we can find, to help you!

And …. the whole team here at the LTC have been sharing the tips that have been shared with them.

Click the buttons below to find out more – Our help and the resources below are FREE!

Please share this page with your licensed hospitality friends and colleagues.

Everyone who works in licensed hospitality can use these resources.

Whether you’ve done 3 days or 30 years, now or in the past, we are able to help people who work in the sale, service, manufacture and distribution of alcohol.

If you've worked 5 years or more we may be able to help with a grant.

Applications for grants are means tested. The financial support we offer is given as grants, not loans, we will never ask for the money back.

Useful Links & Information

Visit the helpforhouseholds.campaign.gov.uk website. The pages on that site are put together by Government and tell you about Government initiatives including grants and financial assistance schemes. A summary of those is below, we recommend you visit the site for the most up to date information:

(Correct at time of publishing September 2022)

| Benefit/grant | Who is eligible? | How much is it, how/ when will it be paid? |

| Cost of Living Payment (CLP) | Anyone with qualifying low-income benefits or tax credits in period 26 Apr to 25 May 22 | £650 in two lump sums of £326 and £324 payable in July 22 and autumn 22. Those on tax credits will get 1st payment 2-7 Sept 22, 2nd payment Winter 22. Automatically paid into bank via HMRC/DWP |

| Disability Cost of Living Payment (DCLP) | Anyone on a qualifying disability benefit as of 25 May 22: Attendance Allowance; Constant Attendance Allowance Disability Living Allowance for adults; Disability Living Allowance for children; Personal Independence Payment; Adult Disability Payment (in Scotland); Child Disability Payment (in Scotland); Armed Forces Independence Payment; War Pension Mobility Supplement; | Lump sum of £150. Automatically paid into bank via HMRC/DWP from 20.9.22 |

| Pensioner Cost of Living Payment (PLCP) | Anyone who is entitled to a Winter Fuel Payment for 2022-23, and is in addition to any CLP/DCLP above | An extra £300 for household – paid with normal Winter Fuel Allowance payment from November 2022. Automatically via DWP |

| Winter fuel payments (added to PCLP see above) | Those on state pension | Most payments are made automatically in November or December. You should be paid by 13 January 2023. If it is not received automatically, it must be claimed by 31.3.23 |

| Energy Bills Support Scheme | All domestic customers in England, Scot, Wales, (regardless of any benefits/support received) | £400 off electricity bill in 6 x monthly instalments between Oct 2022 – March 2023. This will be via an individual’s energy provider automatically given as a credit to account |

| Cold weather payments | May receive if on: Pension Credit, Income Support, income-based Jobseeker’s Allowance, income-related Employment and Support Allowance, Universal Credit Support for Mortgage Interest |

£25 for each 7-day period of very cold weather (0 degrees) between 1 November and 31 March. Paid automatically based on benefits/UC -This year’s scheme opens November 22 |

| Warm Home discount | There are 2 ways to qualify for the Warm Home Discount Scheme: 1. Recipient of Guarantee Credit element of Pension Credit – known as the ‘core group’ 2. Low income and meet energy supplier’s criteria for the scheme – known as the ‘broader group’ |

£150 rebate on fuel bill. Nov 22 – DWP will send out letter to eligible customers but also advised to check with own energy supplier |

| Budgeting loan | Interest free loan repayable over 2 years if on: Income Support, income-based Jobseeker’s Allowance, income-related Employment and Support Allowance, Pension Credit |

The lowest amount you can borrow is £100 up to: £348 single £464 with partner £812 if claim Child Benefit. The repayments will be taken automatically from benefits. The amount to repay is based on income – including any benefits received – and what a person can afford. |

| Council tax rebate | Bands A-D, LA’s will pay and determine who | £150 – payments made from April 22 onwards automatically from councils |

| Help to Heat funding | £12 billion funding in Help to Heat schemes | Via energy suppliers and local authorities, need to apply. The next wave of funding for social housing decarbonisation fund, Wave 2.1, will open in September 22. If property is eligible, social housing provider will contact you. |

The different energy suppliers have support schemes in place to help households. A summary of some of those is below, we recommend you visit their sites for the most up to date information:

(Correct at time of publishing September 2022)

| EDF Energy | 1. Free Energy Hub platform (need a Smart meter) – control over usage and save up to £100

2. Energy Hub Super Saver Challenge – each week all customers taking part have chance to secure a year’s free energy (details to be released from Oct 22 3. Proactively contacting customers most in need and those who switch to smart pre-payment will be given a £100 bill credit 4. Launching ‘Fresh Start’ Campaign supporting those who have existing debt with EDF 5. Launching ‘Helping Hands’ support scheme offering support to prepayment and PAYG customers to ensure they can top up their meters |

| Eon Next | The aim of the E.ON Next Energy Fund is to help E.ON Next customers who are experiencing financial hardship and struggling. The Fund receives donations from E.ON Next and the day-to-day administration is undertaken by Charis Let’s Talk. https://charisgrants.com . There are two ways this fund can help and support:

1. A three-month Provisional Award Scheme for grants to help with paying gas and electricity bills. To be considered for this help, need to show commitment to being financially stable by making regular payments over a three-month period for ongoing usage before receiving an award. The grants are awarded so that customer can take control of finances by clearing household energy debts. While making ongoing payments, Eon will suspend any debts. Once sufficient payments made and the award is confirmed, the debt will be cleared. If, however payments not kept up, the award will be withdrawn and the debt, together with any further debt which has accrued over the three months will remain. 2. Provision of replacement (broken or poor condition) appliance such as a cooker, fridge, fridge-freezer or washing machine |

| British Gas | The British Gas Energy Support Fund The new fund launches on 12th September and is designed to help British Gas customers with an energy debt of between £250 and £750. Further details will be provided mid-September. Individual & Families fund Individual & Families fund is open to anyone with an energy debt between £250 and £750. Don’t need to be a British Gas customer to apply. Details mid-September. |

| Ovo (SSE) | 1. Direct financial relief: Direct Debit relief, emergency top-up, and payment holidays for customers struggling to pay for their energy.2. Hardship Scheme: Additional funds will be allocated to our Hardship Scheme, which will provide additional support for customers via a wide range of interventions, accessed through our dedicated support team.3. Specialist support: Dedicated support for our customers in the most financial difficulty from a highly-trained team, including support for those in financial difficulty for the first time4. Free and discounted products and services: A range of free and heavily discounted products and services like smart thermostats, boiler servicing and electric throws – prioritised for those who need extra support. other assistance: DD payers – For customers particularly impacted by the high cost of living, we have an option to reduce direct debits by up to 15%, giving breathing room until the next direct debit check in. Pay On Demand customers: You will be able to create bespoke payment plans lasting up to 36 months, increasing from the previous 24 months. Prepayment customers: We’re working to increase our emergency credit from £5 to £15. We’re also making sure that if we switch our customers to prepayment plans, we regularly check in to make sure they’re able to manage through this difficult period. We’ll be offering payment holidays for debt repayment for all prepayment meter customers so that every penny put on the meter will go towards heating, not paying back debt this winter.Staying connected this winter: We will not disconnect our customers this winter where they fall behind and encourage all customers who are unable to make their payments to contact us as soon as possible to discuss the tailored support we can offer. |

| Octopus | Have Octo Assist Fund and offer support with paying bills, home energy visits, thermal camera loans to check for heat loss and free energy efficient blankets. |

| Scottish Power | Will be contacting customers who are on variable tariffs with a support package 8-19th Sept 22 |

| Utility Warehouse | offering 5% discount below governments price cap from October 22. Also offering 10% cash back on pre-paid debit card for purchases at Sainsburys, Argos, B&Q etc, and if a dual fuel/multi customer 1% extra on payments anywhere – average earn is £173 per year |

Tips from the LTC Team - We're sharing tips given to us with you!

- I was told that using the oven is more expensive than a microwave so to make sure it’s full (batch cook) then freeze the extras so that you can microwave next time – Paula from the Marketing team.

- I’ve stopped using tumble dryer and either dry clothes on a line outside or clothes dryer indoors, making sure rooms are well ventilated. Also my children are now taking packed lunches to school rather than paying for school dinners every day, they can chose one day each week that they have school dinner – Jola from the Charity Services team.

- An Air Fryer is cheaper than using the oven so if you’ve got one in the back of a cupboard pull it out – Vicky from the Charity Services team.

Tips from Martin Lewis the Money Saving Expert

1. Heat the human, not the home

Martin: “I felt sad when I asked the team to put this new Heat the human guide together, analysing the cheapest ways to keep warm. Yet I can’t ignore my overflowing email-bag of people panicking that they can’t afford their energy bill. Don’t see it as a ‘we say you should’, more as options and info if you must drastically cut down on energy usage.”

2. Over 800,000 qualify for state pension top-up

Pension credit is a tax-free, means-tested benefit aimed at retired people on low incomes – and it can be worth £1,000s a year. Plus it’s a gateway benefit that may make you eligible for council tax discounts, free TV licences for over-75s and more. Check pension credit eligibility.

3. Make do and mend at a Repair Café

Being faced with the expense of replacing big ticket items, such as a laptop, when they’ve broken can be daunting when you’re strapped for cash. But there are ways to lean on the local community to get your stuff fixed for free, as Forumite Brambling explains…

4. 16 million people are out of contract on their broadband and mobile – and could halve bills at speed

Many are on older contracts still paying the bog-standard full price. Yet two minutes on our broadband comparison and cheap Sim comparison tools can often find deals saving over £200 a year – offsetting some of the impact of energy hikes.

5. Or do you qualify for a broadband ‘social tariff’? Some cost £15 a month

Comparisons list deals that are priced hot for a year, but after, to keep it cheap you need to ditch and switch. Yet if you’re on a lower income, for example, claiming universal credit, we’ve a full list of social tariffs which are cheap long-term. Some looking for work are even eligible for six months’ free broadband. David emailed…

6. On minimum wage? Are you actually being underpaid?

It’s thought HALF A MILLION minimum wage employees don’t realise they’ve been underpaid – as their pay may not cover all the time they’re classed as working, or they have to buy items to do their job. If so, you may be due £100s or £1,000s back. Read what to look for in our National minimum wage guide.

7. Choosing between heating and eating? Speak to your council

Councils have just got a new tranche of £500 million for the Household Support Fund, to help provide support to people with their essential costs – and you NEEDN’T BE ON BENEFITS. Frustratingly the last tranche just closed, and there is a new one, but it’s not yet up and running everywhere. However, contact your local authority to see if you are, or will be, eligible (it may also be able to point you to other help).

8. Struggling to afford period products?

The so-called ‘tampon tax’ may have been abolished but many will spend up to £100 a year on period-related products. There is a range of other ways to help with period poverty, including asking for an emergency ‘package for Sandy’ in Morrisons. See our Cheap or free sanitary products guide for more. Kelly Bilsland tweeted us about schemes in Scotland.

9. Easy and FREE £175 for switching bank account – or just grab £20 for trying one

While banks turned the tap off during the pandemic, the switching cash has begun to flow again. There are now many providers in our Best bank accounts guide that pay £100 or more to switch to them. So unless you think your bank can do no wrong, if you need cash, why not take advantage? And if you’re a couple, you can both do it.

Or if you don’t want to switch, via this link First Direct pays you £20 to try it*. You just need to log in to its mobile or web banking within 90 days – you’ve also got that long to switch to it if you decide to, and for this you get a further £155.

10. Get up to £1,500 to help with rising energy prices

Many households in England, Wales and Scotland can get up to £1,500 of Government support this year, designed to help a little with energy bills – though most households won’t be eligible for the full amount. You may be able to get:

- A non-repayable £400 energy grant in October to all households. See £400 energy grant for more info.

- A one-off payment of £650 for those on means-tested benefits. Find out more about the £650 one-off payment.

- A £300 winter fuel payment top-up. A top-up will be paid in November or December to the UK’s eight million pensioners who get the winter fuel payment. You’ll qualify for this payment if you’ll be over state pension age (aged 66 or above) between 19 and 25 September 2022, and as long as you meet certain other requirements – see Gov.uk for full details.

- A £150 top-up for those on certain disability benefits. About six million people across the UK on certain disability benefits will receive a one-off payment of £150 in September. This will be paid straight into the account you currently receive your benefits into and is designed to help towards the cost of specialist equipment and food, and increased transport costs. Find out if you qualify

11. Struggling to pay energy bills? There’s more help available

The first step’s to talk to your supplier to agree a repayment plan that you can afford. But, that’s not the only help available, there are grants, one-off payments and more. Our Struggling to pay energy bills? guide rounds up all the help available from energy firms, the state and charities.

12. Family income under £30,000 (or £50,000 in rare cases)? Check whether you’re due benefits

There are no guarantees you’ll get anything, but it’s worth spending the time seeing if you’re eligible for benefits, especially if you have children. Even if you only qualify for a small amount, it can open the door to other support such as council tax reductions and reduced utility tariffs. Use our 10-minute benefit checker.

13. Attendance allowance helps with extra costs for the disabled and ISN’T means-tested

It’s an often overlooked but really important benefit. Attendance allowance can pay between £60 and £89.60 a week, depending on the severity of your disability. It’s covered within our 10-minute benefit checker tool and Rachel emailed to tell us what a difference claiming it has made…

I just wanted to tell you about my success with applying for attendance allowance for my 81-year-old father. This is a non means-tested benefit for people of state pension age who need help to remain in their own home. My father received the daytime rate of £60 a week and this meant he’s also entitled to a higher rate of housing and council tax benefit. Meaning this year he does not need to pay a penny for his council tax bill and only £5 a week towards his rent. – Rachel

14. Free Burger King, doughnuts, coffee or even get PAID to eat

Take advantage of clever tricks, coupons, apps or cards to eat and drink for nothing (or very cheaply). See Get free or cheap food.

15. Check if your child qualifies for free school meals and the ‘pupil premium’

If you’re on means-tested benefits and on a low income, your child may qualify for free school meals.

Yet it doesn’t stop there. The ‘pupil premium’ can entitle you to other benefits and is generally for some on low incomes. You can apply through your council, as Ellie suggests on Facebook…

16. Grab free food from bakeries, supermarkets and neighbours

Free food and drink-sharing app Olio offers leftover grub for nowt. Instead of binning surplus food, people sign up to the app and offer it to their local community. It’s not just people clearing out their kitchen cupboards, as major supermarkets and retailers such as Tesco and Pret – as well as independent outlets – have also jumped on board. See our free or cheap food guide for how to use Olio.

17. Follow the Bootstrap Cook’s recipes for meals costed to the penny

If you’re trying to scythe down your cooking costs, anti-poverty campaigner Jack Monroe’s Cooking on a Bootstrap site has a host of recipes, all costed to the penny, which may be able to help.

18. Slow cookers can help with cheap batch cooking

Batch cooking involves preparing all your meals for the week or a few days ahead at the same time. This helps cut costs as it means you waste less food and also means you’re less tempted to opt for an expensive takeaway when you can’t be bothered to cook, as the meal will already be prepared. MoneySavers on Twitter told us using a slow cooker is a great way to do this:

19. Get £1,000 in help towards childcare costs

Whether you have a wee tot or a big teen, childcare costs can be huge. Yet 100,000s of working parents are missing out on £1,000s of help with this expense. Our Childcare costs guide covers the available schemes. It’s worth checking.

20. If you’ve a microwave, it’s usually cheaper than an oven

Microwaves are high wattage but tend to be used for less time, and crucially they only heat the water in food, not the air surrounding it as in an oven, so there’s less wasted energy. We’ve estimated that microwaving a jacket potato often costs 25% or less of what it would cost oven-cooking one.

21. Pay attention to regular payments (direct debits, standing orders, recurring payments) – one problem can cost you again and again

There are three types of regular payments, all of which let money drip from your accounts without needing your approval. That’s dangerous, so you need to regularly check.

– Direct debits: Where you give a firm permission to take a variable amount of cash from your account.

– Standing orders: Where you ask your bank to regularly pay someone a fixed amount.

– Recurring payments: These are little known, and hidden. This is where you give firms permission to take a ‘payment’ each month from your debit or credit card.

Your bank should be able to provide you with a list of the first two. Finding recurring payments takes a little digging through statements.

Once you’ve got the payments, first decide if you still want the goods or service. If not and you’re out of contract, cancel. If you do need it then the next question is, can you do it a cheaper, or a better, way? Full help on this, and your rights, in our How to do a direct debit audit guide.

22. 100,000s of free water-saving gadgets available – help cut energy bills too

Water firms hand out free water-saving gadgets via water efficiency site Save Water Save Money. These include shower heads, tap inserts and garden hose nozzles. As well as saving money for those on water meters, as much of the water we use is heated, it reduces energy bills too.

23. Claim up to £200 a year towards school uniform costs

Lower-income families could get as much as £200 a year towards the cost of their children’s school uniform – saving £100s or even £1,000s (if you have more than one child) over their school years.

With the cost of living crisis causing new financial hardship, many will now qualify, so check to see if you’re one of them and what you could get. We’ve more info in our Can I get help towards my child’s school uniform costs? MSE News story.

24. Get free and cheap meals by grabbing intro offers

Food box subscriptions might seem like a luxury but if you take advantage of introductory offers, you might be able to get free or hugely discounted meals. We regularly publish offers via our Food & Drink deals page and in our weekly Money Tips email. Julie tweeted to tell us how she’s making the most of these…

25. If you live alone, with students, have a ‘severe mental impairment’, have a live-in carer, receive pension credit or are on a low income, you could get a council tax discount

Discounts can range from 25% to 100%, depending on your circumstances. See Council tax discounts for full eligibility information.

Bear in mind also that some discounts aren’t automatically applied, as Anne points out on Twitter…

Please make it clear that if you are claiming Universal Credit you need to make a separate claim for Council Tax Reduction from your local council – it is not automatic. If you didn’t make the claim at the same time you can ask for it to be backdated but this is limited.

— Anne (@ClaytonWoman) March 31, 2022

26. Pregnant, have a child under four and on benefits? Get free food with Healthy Start vouchers

Healthy Start (Best Start in Scotland) vouchers can be used by families on low incomes to buy cows’ milk, formula milk, fruit and veg and other food. You need to be at least 10 weeks pregnant, have at least one child under four and be receiving certain benefits to qualify. Apply via the NHS but we’ve more info in Maternity grants.

27. If you’re on benefits and have a disabled child, you could get cash from the Family Fund

If you’ve got a disabled child (17 or under) who lives at home and you receive certain benefits (such as income support or universal credit), the Family Fund has grants to help make life easier. These can be used on items or activities such as washing machines, computers and holidays. Sandy tweeted…

28. Are you a new parent, or about to be and on benefits? You may be due £500

If you’re pregnant or have a baby under six months old, and you or your partner are on certain benefits, you may qualify for a one-off £500 (£606 in Scotland) maternity grant. This doesn’t have to be repaid. You may get more if you’re having twins or triplets.

29. Do an annual stocktake – if you haven’t used something for a year, flog it

If you’ve got stuff that’s just gathering dust, then consider selling it to make some extra cash. See our eBay tips and tricks guide, Facebook selling tips, and nine ways to sell your clothes. There are even ways to make money from crisp bags, empty jam jars and wine corks. See Flog your rubbish for what sells. Forumite Rachel sells a lot of old stuff…

30. Wear a uniform (for work that is)? Claim tax back

If you wear a recognisable work uniform (for example, a branded T-shirt), and wash or repair it yourself, you can likely claim a tax rebate. This could be £100s as you can claim up to five years of expenses, but don’t pay a claims firm as you can do it yourself for free. Full help is in our Uniform tax rebate guide, and Jen on Facebook is spreading the word on the benefits…

31. Free or discounted healthcare – prescriptions, dental, eye care and more

Prescriptions in England cost £9.35 (they’re free elsewhere), though some groups in England do qualify for free prescriptions, such as if you’re under 16 or over 60, have certain medical conditions or are claiming certain benefits.

Use the NHS England tool to check if you’re exempt from paying and also qualify for free dental check-ups and treatment. The NHS Low Income Scheme can also help with the cost of some health treatments.

32. Claim back costs for routine NHS and private treatments with a healthcare cash plan

These insurance policies start from just £7 a month and allow you to claim back the cost of NHS dental treatment, optician costs, physio and more. See Top healthcare cash plans for more details including info on how to use them correctly.

And don’t forget to check if your employer offers free healthcare cash plans as part of your benefits, as Carole pointed out on Facebook.

33. Are you one of one million people overpaying for prescriptions?

Over one million people in England from April 2020 to April 2021 would’ve been better off using an NHS prescription prepayment certificate, a kind of season ticket. They allow you to pay a one-off fee that covers the costs of all prescriptions for a period of three months or one year. If you use more than one prescription a month on average, it’s worth it. MrsRieB tweeted…

34. Check if you live near a social supermarket or community shop

These are social enterprises that are generally, but not always, aimed at those on low incomes, selling surplus from major supermarkets at heavily discounted prices. While not widespread, they’re growing in number – see where to find social supermarkets. Happy tweeted us about Company Shop, which offers free membership for people on certain benefits, and has 15 stores.

35. Please don’t go hungry – foodbanks are there to help with the basics

If you’re struggling to afford food, there are places that can help. You can and SHOULD use them – don’t let pride get in the way. Foodbanks give out free parcels that should provide at least three days’ worth of in-date, non-perishable food. Two-and-a-half million were given away last year – and there’s no shame in it.

To get help from most foodbanks, you need to be referred (though this isn’t the case with some independent foodbanks). You can typically get referred by a doctor, health visitor, school or social worker. If you’re not sure who to talk to, try asking Citizens Advice.

The Trussell Trust is one of the biggest foodbank charities in the UK, where it runs two-thirds of foodbanks – see if it operates near you. Helen tweeted…

36. Watch the weather for when to wash – get tactical when using your washing machine

Doing one fewer load of washing a week, using your machine on a 30-degree cycle and making sure your machine is full when you use it can save about £28 a year on your energy bill, according to the Energy Saving Trust. Fran tweeted that she times her washing with the weather to avoid the tumble dryer…

37. Check if you’re in too high a council tax band – you may be due £1,000s back

Due to the bizarre way properties were valued when the council tax system was launched in 1991, over 400,000 homes are in the wrong council tax band – and many are in too high a band. Martin created his council tax check ‘n’ challenge system in 2007, and it’s worth trying to see if you could claim back £1,000s if your property has been in the wrong band. Flip tweeted us…

38. It’s an oldie but a goodie – take the ‘Downshift Challenge’

Martin started doing TV programmes about this in the early noughties. He’s stopped now because it’s so obvious but it’s become a staple of other money makeover shows ever since.

The Downshift Challenge is essentially dropping down a brand level on groceries – for example, ‘finest’ to ‘branded’ to ‘own brand’ to ‘basic’. If you can’t taste a difference, stick with the lower level. On average it cuts 30% off bills, so if you only stick with half, that’s 15% saved. It’s not just food either – you can do it with toiletries and cleaning products, as Nic on Facebook suggested:

39. ‘Boil ‘n’ flask’, shower in public – creative ways to minimise energy use

MSE’s followers and Forumites came forth with lots of innovative ways to minimise energy use. The frugal fuel tips on the MSE Forum is a great place to start, but we had other suggestions via Twitter, too.

Go on Freecycle/join a local Facebook group where people are giving away free items. Boil water for hot drinks once a day and save the rest in a flask to save electricity. Forage food (made nettle tagliatelle, nettle and potato soup, dandelion flower jam etc during hard times).

Forumites arnoldy and TheBanker have these simple but clever ways to ensure you’re not taking too long in the shower…

40. How to find free films and box sets online

Some will spend £100s a year on TV subscriptions, but there are loads of ways to slash the cost, and you may not even need to pay for TV. All 4 has more than 280 box sets and you don’t need a TV licence to watch them, while Rakuten offers a number of free films outside of its paid-for service. See our TV MoneySaving tricks, including how to save on Netflix, Sky, Now and more.

41. ‘Fakeaway’ takeaways

There’s a growing range of fast-food items in the supermarkets that allow you to recreate your favourite takeaways for a fraction of the cost. Or you can make your own – try a DIY ‘Nando’s’ whole chicken for £4.90, with a supermarket chicken and two packs of 95p peri-peri rub. See 10 ‘cheapy’ Nando’s MoneySaving hacks.

42. Find free furniture, clothing, food, toys and more

There are free-to-join online groups where people offer up their unwanted possessions for free – everything from sofas and fridges to baby buggies and DVDs. See our Freecycle & Freegle guide for how to use them.

43. Cut dishwasher tabs in half and 43 more household hacks

From cutting open toothpaste to get the last squidge out, to saving wrapping paper from opened gifts… many of us have certain quirky things we do as MoneySavers. We might not always admit to them, but however small (or strange), they all add up to save cash. See our 44 MoneySaving household hacks.

44. Live by Martin’s Money Mantras – one for if you’re skint, one for if you’re not

You can print a free wallet-sized Money Mantra card, pop it in your purse or wallet, and whip it out before you buy anything to remind yourself.

45. Quite simply STOP spending

Sometimes these two simple words are what’s really needed. Easier said than done, of course, but there are plenty of things that you can do to fight the spending impulses. Block notifications and emails from shops and restaurants to bat away temptation, leave debit and credit cards at home, or calculate how many hours you’d need to work to earn back the money you’d spend buying something.

We’ve 25 tips in How to stop spending, plus use our fun but frightening Demotivator tool to keep your impulses in check.

46. Start virtually clipping coupons

Currently, there are over 40 discount coupons available for supermarkets, so focus your shopping on these. We round up all the latest in our 40+ supermarket coupons guide (updated every month).

47. Huge network offers up free food from ‘community fridges’

There are thought to be 250 ‘community fridges’ across the country, allowing people to take food when they need it. Check if any are local to you via the Community Fridge Network – two MoneySavers explain how they work…

48. Can’t afford to clear credit and store cards in full each month? You can’t afford not to check if you can get a 0% balance transfer

This is not us advising you to borrow to see your way through the crisis. But if you’ve got existing credit and store card debt and are paying interest, it’s always worth seeing if you can save with a balance transfer card. These allow you to shift debts from old cards to a new one with 0% interest, so every repayment cuts your actual debt.

Of course, getting accepted is the big problem, so the easy way to do this is to use our Balance Transfer Eligibility Checker, which helps you see the deals available. And crucially, it gives your chances of being accepted, before you apply, which means it has no impact on your ability to get credit in future.

49. Drive down the cost of fuel

The price of petrol and diesel has hit record highs recently, but by using the free cheap fuel finder tool at PetrolPrices.com you can find the cheapest near you. Slow down costs further by driving more efficiently – we’ve plenty of ways to do it (with help from the RAC) in our Cheap petrol & diesel guide.

50. Cut the cost of haircuts with trainee hairdressers or doing it yourself

Salon haircuts don’t always come cheap, but one way to trim back the cost is to look for one that has trainee hairdressers. Your haircut may take a bit longer than normal (as it’s overseen and checked by a fully-qualified hairdresser) but you’ll usually pay far less than the normal price.

For example, Toni & Guy offers trainee haircuts in London and Manchester for £10 (normally £50-£80). Even if your salon doesn’t have trainees, asking for a junior stylist can often be much cheaper than one with more experience.

Or, you could have a go doing it yourself. See our DIY haircut tips with videos from the pros and dos and don’ts from the MSE team and MoneySavers who’ve tried cutting their own hair.

51. Speedy app finds you end-of-day discounts at cafés and restaurants

Free app Too Good To Go can cut costs and food waste by offering up leftovers at a discount from local cafés and restaurants at the end of each day. Operating in England, Scotland and Wales, Too Good To Go sells a £2 to £4 ‘magic bag’ which it says will be worth at least three times as much at full price. See our Free or cheap food guide for full info on how it works.

52. Quickly check if you can save £100s with a water meter

You can’t switch between providers, so the most important decision is how you’re billed. Martin’s rule of thumb is:

If there are more bedrooms in your home than people, or the same number, check out getting a meter.

The Consumer Council for Water has a free water meter calculator that tells you if you can save with a meter. It asks questions about your water use and tells you your estimated costs if you had a meter. David emailed us with his success…

My water bills were £1,200 a year. I got a water meter and it brought them down to £550 [saving £650 a year].

Well worth considering. Thanks. – David

If it’s not possible for you to have a meter fitted, don’t give up. You can ask for an assessed measured charge.

53. Get your water bills massively reduced or capped if you’re on a low income

If you’re struggling to pay your water bills or claim benefits, there are a number of schemes and even assistance funds that can help. We’ve full info in Cut water bills, and Sophie tweeted us about one of them…

Every water company has a scheme called Watersure for those with 3 or more children under 18 at home and entitled to child benefit or any amount of certain other benefits, or someone with a medical condition that requires the use of more water, they also have Watersure Plus…

54, Can’t afford your bill, but don’t want to switch? When it comes to TV, mobiles, breakdown and broadband, haggling may help

If you’re happy with your current broadband service for example, or don’t want to ditch Sky TV, then try to haggle the cost down. If you’re out of contract, use comparison sites to benchmark the best deals around and ask your firm to match them. Remember that politeness and charm works the best. See how to haggle with Sky, the AA and more. We’re inundated with haggling successes, including from Lorraine, who emailed…

55. On benefits? You could be entitled to a free leisure card which gives you discounted swimming and other activities

If you receive certain benefits, you could be entitled to a free leisure card, which gives discounted swimming and other activities at council-run leisure centres. To apply, you’ll need to contact your local authority. Tara alerted us to this one via Facebook…

56. If you have spare time, see ways to boost your income – you could even do it by playing video games or becoming a life model…

If you’ve exhausted all you can to cut your bills, take a look at how you can earn extra money. Some are fun, others require the means and a bit more effort. Scan our bumper list of 60+ ways to boost your income, which include earning £50 to £200 road-testing video games, getting a £30 Amazon voucher doing quick online surveys, and even becoming a ‘life model’.

57. Supermarket shopping baskets are dangerous. Don’t pick one up unless you really need to!

The more you go to a shop, the more you could be tempted into buying things you don’t need, so do one big shop a week where possible. If you must go in between, baskets are dangerous – as if you have them, you tend to fill them up easier with unnecessary items. So if you’re only going in for a pint of milk, don’t pick up a basket as you’ll likely buy more than just a pint of milk. See our supermarket shopping tips for more tricks to slash your food bills.

58. If debt is giving you sleepless nights, get free one-on-one advice

There are two ways to deal with problem debt. Which one is right for you depends on whether you have worrying or large debts or whether you’re in a debt crisis.

What counts as ‘debt crisis’ depends on who you ask, but a good indication that you might be in one is if you answer “yes” to either of these two questions:

- Are you struggling to pay all basic outgoings, for example, mortgage, rent, energy bills and minimum credit card payments?

- Are your debts (excluding your mortgage) bigger than a year’s after-tax income?

If you’re in debt crisis, don’t panic. No debt problem is unsolvable. It might not be easy or quick to resolve, but there’s always a route. First, read our debt help checklist. Then access free one-to-one help – there’s a range of great, free, non-profit debt-counselling agencies to support you if you’re in crisis.

If you’ve got debt problems but are NOT in a debt crisis, see how to get help and support from those in the same boat.

If you’re struggling with debt and mental health problems, we also have a free Mental Health and Debt booklet to help.

If you’re one of the 100,000 people who have an Individual Voluntary Arrangement (IVA) to help reduce your debt, you may be able to get help.

In light of the current cost of living crisis, The Insolvency Service has issued new guidance allowing people with an IVA to request to lower their monthly payments. This may make you eligible for other more affordable options, such as a debt relief order (DRO), or even have your IVA ended early. If this applies to you, get in touch with your insolvency practitioner.

59. Got any old mobiles lying around? They’re worth cash, so trade them in

If you have old mobile phones you’re not using, you could make serious cash by selling them. While eBay often nets max cash, for speed and ease, plug your info into trade-in sites. We found one site, for example, that pays £149 for a 64GB iPhone XR. See full info in Sell old mobiles.

60. Are you married or in a civil partnership? Is one of you a basic-rate 20% taxpayer and the other a non-taxpayer? You may be due up to £1,250 tax back

If you’re married or in a civil partnership (not just cohabiting), and one of you is a NON-taxpayer and the other pays tax at the basic 20% rate, you qualify for the marriage tax allowance. It lets the non-taxpayer transfer 10% of their tax-free allowance to their spouse so they pay less tax.

It’s worth up to £252 in 2022/23, but backdate it for the full four years allowed and it can be worth a further £990. Once you’ve claimed you needn’t claim again, as provided you’re still eligible you can keep getting it. Ian emailed us his success…

61. Cook multiple meals at once to be more efficient

Getting your oven up to the right temperature uses a lot of energy, so if you can make full use of the oven each time you heat it up, rather than just cooking one item, you could save in the long-run. Fran tweeted us to suggest this one…

62. Know where to store your bananas, eggs, bread and so on to avoid wasting food (and money)

This is about keeping the right food in the fridge to keep it fresh and avoid having to chuck it. See this and other ways to stop wasting food and drink.

63. If you’re able to treat yourself to cinema tickets or eating out, there’s a way to get a year’s 2for1 for £1

The 2for1 meerkat trick gets you a discount at 1,000s of restaurants from Sunday to Thursday and at cinemas on Tuesday or Wednesday.

64. Tesco shopper? Check your Clubcard points and swap them for up to 3x value for days out and more

Convert your points to Tesco vouchers to use at a store and 500 points are usually worth £5, but spend them the right way and those 500 points could be worth £15. You can exchange Clubcard vouchers for codes to spend on days out, dining out, a railcard and more. See our Tesco Clubcard boosting guide for more on getting the max out of your points.

65. Get up to 10% cashback off mobile bills by doing normal spending

The free Airtime Rewards app tracks your spending at 100+ retailers – such as Argos and Boots – and pays 1% to 10% cashback, which you can redeem as credit on your mobile bill. Better still, you can use it alongside other cashback sites for a double win.

This isn’t an excuse to overspend – it’s just a minimal effort way to earn rewards on normal spending. See our full Airtime Rewards analysis.

66. Have a child with additional needs? A parent-carer council can help ensure you’re getting all you’re entitled to

67. Get PAID to recycle old clothes or beauty containers

Many high street stores offer incentives for recycling their old clothes and beauty containers – from £5 for old clothes, to ‘free’ MAC lipsticks and more. See our recycling rewards list.

68. Find out where to fill your bottle for free so you don’t need to buy water when out

Rather than buying bottles of water when you’re out and about, see if you can refill for free. An app shows which cafés, shops and so on let you fill up your bottle for free, even if you’re not a customer. It lists over 30,000 locations, across about 100 parts of the UK where the scheme operates.

69. Avoid throwing edible food away – know your ‘use by’ from your ‘best before’

About seven million tonnes of food is thrown away each year in the UK. Many wrongly chuck food that’s still edible – wasting food and money – due to misunderstanding the difference between best-before and use-by dates:

- ‘Use by’ is a health issue. Don’t eat anything beyond that date, as it’s risky, even if it looks and smells fine, so it’s best to bin.

- ‘Best before’ is just the manufacturer’s view of when it’s no longer at its optimum quality. Use your eyes and nose to check if it’s safe to consume. In fact, there are beyond best-before online shops which offer substantial savings.

70. Drive less, walk or cycle more

It may sound obvious, but with the cost of fuel at near-record highs, think before you get behind the wheel. Could you walk or cycle instead? See our 12 MoneySaving tips for cyclists, which can help cut your costs, including how to get cheap second-hand bikes, save £100s if your employer offers a ‘Cycle to Work’ scheme and cheap ways to hire a bike short-term.

Or if you’re a glutton for punishment like Martin, take the 10,000 steps a day challenge and walk everywhere. For inspiration, see Martin’s How I averaged 25,437 steps a day in 2021 blog.

71. Tesco, Sainsbury’s, Morrisons or Lidl shopper? Unlock special discounts which could save £100s

These days it’s not just points you can earn, as supermarkets have introduced hidden deals just for their loyalty scheme members.

- Tesco’s ‘Clubcard Prices’ give up to 50% off various items (which vary by store) just by using your Clubcard – we’ve recently seen £1.50 McCain fries (normally £3) and £1 Kellogg’s Rice Krispie Squares (normally £2).

- Sainsbury’s says you can save £200 a year with personalised up to 30% discounts via its SmartShop app.

- Morrisons gives money-off regularly bought items via its My Morrisons app – for example we’ve seen 20% off fruit and veg, as well as occasional discounts off your entire shop, such as £5 off £40.

- Lidl offers up to 30% discounts on items via its Plus app – we’ve seen 30% off bakery items, 20% off crackers and 15% off coffee.

Our supermarket shopping tips guide has full info

72. Nifty tools to use up larder leftovers

Before doing your grocery shop, see how long you can go using what you already have in your cupboards. You might find you’ve already got a month’s worth of dinners you could make. To stop wasting food that you don’t know what to do with, there are handy sites that help.

Tell the SuperCook or BigOven tools what items are in your fridge or cupboard and they’ll suggest a recipe for them from thousands. Alternatively, just go to the MSE Forum’s Old Style Recipe Index and scroll down to the relevant ingredient.

73. Know the best times to get the biggest ‘yellow sticker’ reductions

Yellow stickers are a stock-in-trade for bargain hunters. These are the discounted items soon to be at their best-before dates that supermarkets reduce. But the key is to be ready to pounce at the perfect time. We’ve craftily gathered insider info from supermarket staff and shoppers on when stores want to offload stock, to help you time your trip right. Sarah tweeted us with this success…

74. There are more railcards than you think – if you use the train, check if there is one for you

There are now railcards that cover a family, anyone aged under 31, over 60, disabled, or two people who regularly travel together – for example going to the football. They cost up to £30 a year and get you a third off most train travel, so if you’ll spend over £90 a year, you can save –see Can I get a railcard? for more.

75. Consider smaller discounters over big supermarkets

No one supermarket is cheapest, and sometimes it’s worth considering smaller discounters over the major supermarkets as they can be cheaper. Consider Lidl and Aldi if you haven’t before and if you already shop at these stores, it’s worth trying Home Bargains and B&M, too. These can often prove cheaper than big supermarkets – as Alexandria told us in the tweet below.

This is just one of 29 supermarket shopping tips – see our guide for loads more tools and tricks to slash bills.

76. Hone your charity-shop bargain-buying techniques to bag a higher-end wardrobe on a budget

While everyone knows charity shops are a great way to pick up cheaper clobber, there is a science behind it. We explore this in our charity shop bargain-hunting tips, where we show you where and when to find the best items (including designer gear), how to spot sales, and tips on buying online, so you can fill up your wardrobe for less.

77. If you’re going to spend, try to get some of your money back via a cashback site

Cashback sites pay you when you go through them to spend with retailers or providers, so you can get some money back on your normal spending (though of course, cutting back is what’s important right now). We’ve full info and safety rules in Top cashback sites.

78. Employee or pensioner? Check your tax code – millions are wrong and you may be owed money back

Tax codes are the short series of numbers and letters, such as 1257L, that tell employers or pension providers how much tax to take from you. Millions are wrong each year, and the rules say it’s YOUR RESPONSIBILITY to check that yours is correct (not your employer’s or HM Revenue & Customs’). So use our Tax Code Calculator to check if yours is likely right or wrong – you could be owed £1,000s, so it’s well worth doing.

79. Save 60%+ on rent by becoming a ‘property guardian’

This isn’t for everyone, but generally if you are single and can be flexible on where you live, it’s worth considering. In exchange for cheap rent, you can baby-sit empty properties to deter squatters – these can be private homes, office blocks, fire stations, churches, schools and more. When we checked, we found a room in an old bank in Bournemouth from £250 a month, and one in London’s West Hampstead for £350 a month. See full info in property guardians.

80. Share Wi-Fi and Netflix costs with your neighbour?

This will work, but the legality could be complex on who is responsible for the actual broadband, so it’s worth thinking about before you do it. But this is an interesting tweet from CJ. As for the legalities of sharing Netflix, see our Netflix hacks where we discuss it.

81. Get paid for your opinion

If you’re willing to give views on anything from washing-up liquid to politics, then it’s possible to earn a bit of spare cash on the side, without any special skill or talent. It’s all about stashing cash by filling in online surveys. For a full rundown of 25 of the top free sites, see our Top online survey sites and apps guide.

82. Stick to a list and never shop hungry

Before heading to the shops, make a list of what you need. It sounds obvious, but if you go shopping without a list, it’s too easy to end up picking up a load of stuff you didn’t intend to get and you probably didn’t need.

It’s also not a good idea to go food shopping when you’re hungry either. If you do, then you run the risk that before you know it, you’ve got Henry the 8th levels of food in your trolley – it makes sticking to that list a lot more difficult.

See our Supermarket shopping tips for more tricks and tools to slash food bills.

83. Tool up on your financial knowledge to protect yourself on the big stuff via MSE’s Academy of Money

Small financial mistakes at the moment can have huge consequences, so the more knowledge you’ve got, the more you’re protected. The ‘MSE Academy of Money‘ course, written by the Open University with our support and guidance, is made up of six two-hour sessions of study. These cover the key aspects of personal finance, including spending, borrowing, mortgages, saving, investing and retirement.

The course is totally flexible – students can study at their own pace, and can even choose just one topic to brush up on. It is available to anyone wanting to improve their knowledge of personal finance for their own interest and financial capability, or for those who work in the consumer help industries – it can provide some academic grounding to support their work.

84. Take advantage of free outdoor gyms to save £100s on gym membership

There are hundreds of council-funded outdoor gyms that are free-to-use all year round – they’re mostly found in open recreation areas and parks. So if you need to cut back on gym membership, consider giving free outdoor gyms a try.

85. If your mobile storage is full, don’t panic that you need a new phone – you can get free online storage for your photos and videos

If your phone’s full of photos and videos, or you need to back up your computer, you can use free online storage services to bag yourself 35GB+ of free extra space. This could save you having to fork out for a new phone, or pricey online storage. Our Free online storage guide explains how online storage services work and how to make sure they’re safe, then rounds up the best of the free services out there.

86. Days out don’t have to be pricey – you can visit FREE museums

Wherever you are in the UK, chances are you’re not too far from a free museum or art gallery which can make for a cheap and interesting day out. Our Free museums & galleries guide is split up by region to help find what’s near you.

87. On a low income? Check if you’re missing out on an income support grant

If you’re struggling on a low income, there’s a lot more cash out there to help than you may think. Charities, the Government and even companies often have funds available to help, especially if you’ve got children. We’ve already mentioned a couple of grants in this guide, the maternity grants and the Family Fund, but there are loads of others out there, including small charity grants and home improvement grants.

And this free money often goes unclaimed. So while there are no guarantees, it’s worth checking our Grant grabbing guide to see if you could get any of them.

88. Do you have young children? If struggling to afford everyday items, you can get free children’s oral hygiene products at Boots

Boots says if you visit one of its stores and ‘ask for Jesse’, a member of the team will discreetly give you a pack of dental products for children aged three to five, in partnership with The Hygiene Bank. Joy tweeted us about this initiative to support hygiene poverty.

89. ‘A stitch in time saves nine’ – nip little repairs in the bud before they get worse

Procrastination can often be costly when it comes to ignoring any little repairs or easy maintenance jobs that may need doing. Forumite dansmif warns how putting off these simple jobs can cost far more in the long-run…

90. Unemployed and looking for work? Get your interview outfit dry-cleaned for free

Retailer Timpson offers free dry-cleaning to anyone unemployed who needs their suit/outfit for a job interview. Just ask for the deal at the counter – staff are likely to check it’s for a genuine interview. It’s available at all Timpson stores with dry-cleaning facilities.

91. Set up a clothes or plant etc swap with friends, neighbours or colleagues

Instead of buying new, such as clothes or plants, consider setting up a ‘swap event’ instead. You could do this with friends, neighbours or with colleagues at work. For inspiration, in 2019 MSE Rhiannon hosted a clothes swap at MSE Towers, and at the start of May this year, MSE Laura F organised a plant cutting swap.

92. Grow your own veg to add some cheap nutrition to your meals

Whether you’ve a garden or windowsill, it’s possible to grow your own vegetables and herbs such as cress, lettuce and radish. Forumite thriftwizard says it’s great for adding to sandwiches or salads…

See MSE Forumites’ grow your own tips.

93. Take the ‘No-Spend Day’ challenge

This has been popular for years in the MSE Forum with people looking to radically reduce their spending, normally because they’re in debt. It’s simply because spending is habit forming, so make a decision once or twice a week – it’s best on a set day or days, for example, a Monday and a Thursday – when you will spend absolutely nothing. These are your ‘No-Spend Days’, or ‘NSDs’. Quite often this can help you break the cycle for the rest of the week too.

94. Get more in-depth advice or practical support

If you need extra help or support, many other organisations and charities offer detailed guidance and advice. Here are just a few that you may find useful:

- National Energy Action: For help paying energy bills (or Home Energy Scotland)

- Turn2us: Help with benefits, searching for grants and accessing support services

- Citizens Advice: Guidance for all aspects of universal credit

- Gingerbread: Primarily aimed at single parent families